What are single pattern candlestick//Single Candlestick pattern

Understanding Single Candlestick Patterns in Technical Analysis

Introduction: Candlestick patterns are popular tools used in technical analysis to interpret price movements in financial markets. These patterns provide valuable insights into market sentiment and can help traders make informed decisions. In this article, we will focus specifically on single candlestick patterns, which consist of a single candle and offer valuable clues about the future direction of a market

.Doji:

The Doji candlestick pattern is characterized by a small body, where the opening and closing prices are virtually the same. It indicates a state of indecision in the market, with neither buyers nor sellers having control. Traders often look for confirmation from nearby candles or trendlines to determine the next move.

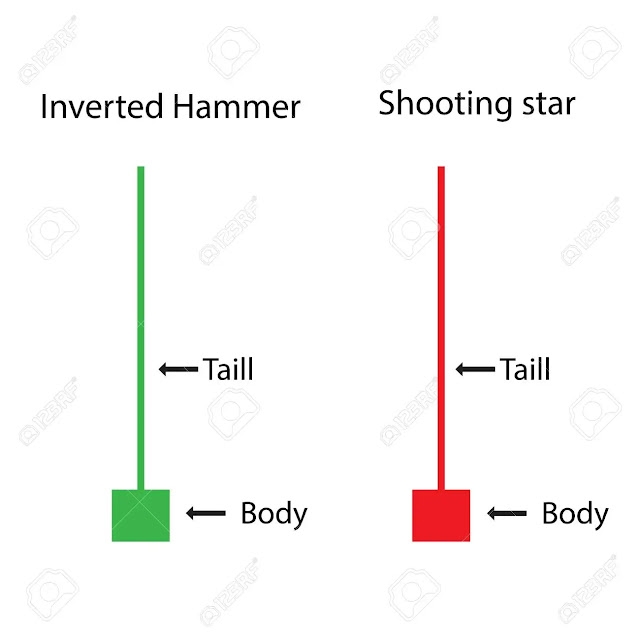

Shooting Star:

A Shooting Star candlestick pattern has a small body near the bottom of the candle and a long upper wick. It suggests a possible reversal from bullish to bearish. The long upper wick indicates that buyers initially pushed the price up, but sellers regained control, causing the price to fall.

Spinning Top:

The Spinning Top candlestick pattern has a small body with upper and lower wicks of similar length. It indicates indecision in the market, with buyers and sellers evenly matched. This pattern suggests that the trend may be losing momentum, and a potential reversal could occur.

Marubozu:

A Marubozu candlestick pattern has a long body with little or no wicks. There are two types of Marubozu: a bullish Marubozu, which indicates strong buying pressure throughout the session, and a bearish Marubozu, which signifies strong selling pressure. Traders often interpret this pattern as a continuation of the existing trend.

Conclusion: Single candlestick patterns can provide valuable insights into market dynamics and help traders anticipate potential trend reversals or continuations. However, it is important to note that these patterns should not be viewed in isolation. It is recommended to analyze them in conjunction with other technical indicators, support and resistance levels, and overall market conditions for a more comprehensive understanding. Regular practice and experience are key to mastering the art of recognizing and interpreting candlestick patterns effectively.